net investment income tax 2021 trusts

In comparison a single individual is subject to the NIIT on the lesser of net investment income or excess modified adjusted gross income over 200000 for single filers and 250000 for married couples filing. The 25000 of undistributed net investment income comprises the capital.

How To Calculate The Net Investment Income Properly

Trusts Estates and the Net Investment Income Tax.

. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. But not everyone who makes income from their investments is impacted. Section 6013g election see instructions.

Overview of the net investment income tax. Undistributed net investment income and adjusted gross income AGI in excess of the threshold amount. And depending on how much money you make annually you may also be responsible for net investment income tax.

This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts. Tax more commonly referred to as the net investment. The NIIT is 38 of the lesser of.

The undistributed net investment income for the tax year. Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021. When the Patient Protection and Affordable Care Act healthcare reform was passed in 2010 it included a tax increase that went into effect for this tax year.

If you profit from your investments this ones for you. As a result any net investment income generated by the trust is included in the grantors net investment income potentially subject to the 38 tax at. Your social security number or EIN.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. Youll owe the 38 tax. Go to wwwirsgovForm8960 for instructions and the latest information.

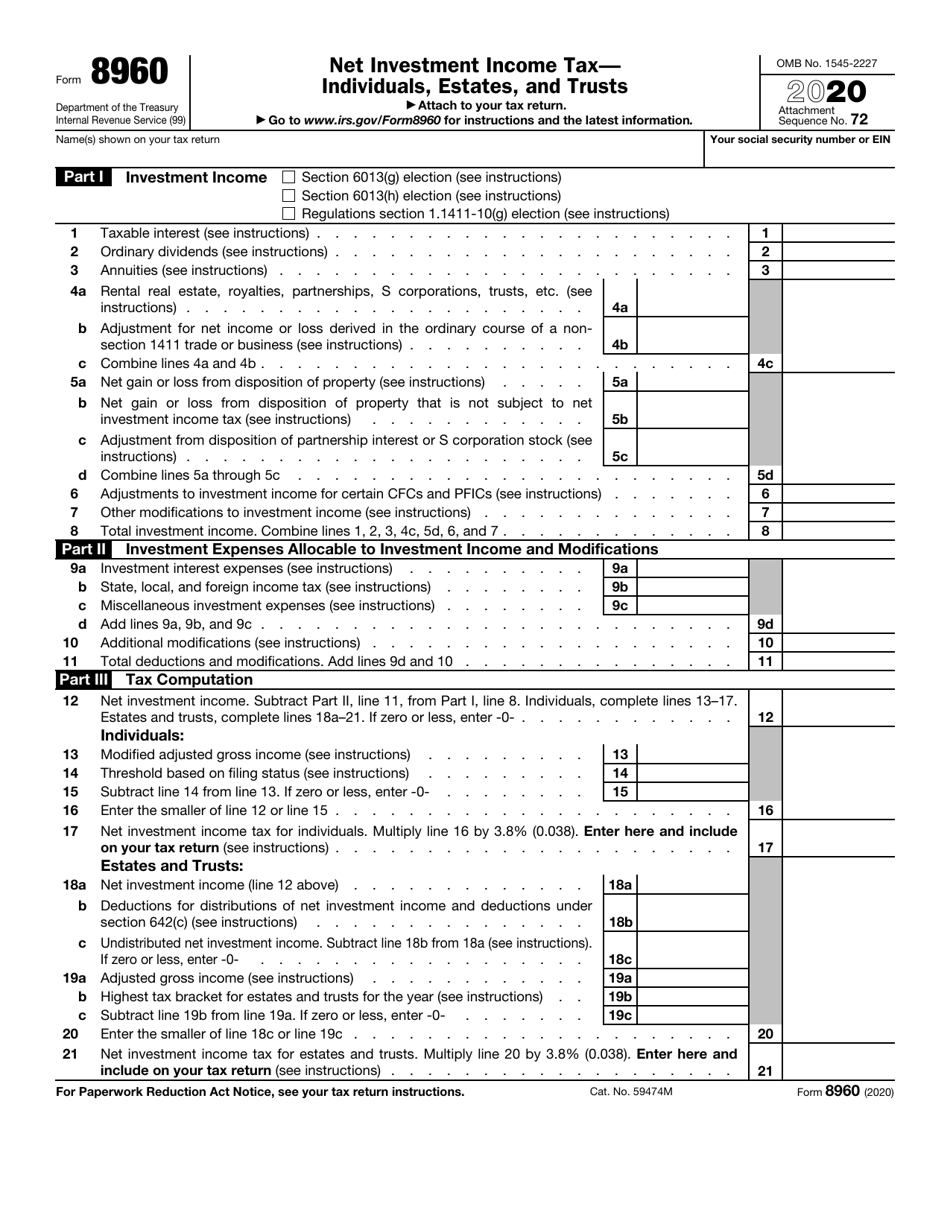

Taxpayers use this form to figure the amount of their net investment income tax NIIT. The 38 Tax You May Need to Worry About. Names shown on your tax return.

7 - Salary deferrals 401k 403b etc can reduce MAGI for the 38 surtax but cannot reduce earned income for the 09 additional Medicare tax. Your additional tax would be 1140 038 x 30000. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold.

The statutory authority for the tax is. Rachel Blakely-Gray Jul 15 2021. The 38 Net Investment Income Tax.

You can download or print current or past-year PDFs of Form 8960 directly from TaxFormFinder. A 38 tax on net investment income. Trusts undistributed net investment income is 25000 which is Trusts net investment income 30000 less the amount of dividend income 3000 and interest income 2000 distributed to A.

We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960 fully updated for tax year 2021. NIIT imposes a 38 surtax on income from investments. Net Investment Income Tax Individuals Estates and Trusts Attach to your tax return.

Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage.

In general net investment income for purpose of this tax includes but isnt limited to. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

Part I Investment Income. An additional Medicare tax of 09 also applies to earned income subject to employment taxes discussed in. If your Modified Adjusted Gross Income exceeds 200000 or 250000 if youre married and filing jointly you may be subject to the NIIT.

Subject to a 38 unearned income Medicare contribution. Estates and Trusts are subject to NIIT if they have undistributed net investment income and also have adjusted gross income over the dollar amount at which the highest tax bracket for an estate or trust begins for such taxable year. Investments includes portfolio income items such as interest dividends and short-term and long-term capital gains.

Since 2013 certain higher-income individuals have been. You can print other Federal tax forms here. Royalties rental income and business income from activities that are treated as passive are also subject to the surtax.

The net investment income tax also known as the unearned income Medicare contribution tax was introduced as part of the Health Care and Education Reconciliation Act of 2010 PL. For 2021 a trust is subject to NIIT on the lesser of the undistributed net investment income or the excess of adjusted gross income over of 13050. Trusts 60000 of taxable income attributable to the IRA is excluded from net investment income.

Youre responsible for paying capital gains tax. The net investment income tax is a 38 surtax that is paid in addition to regular income taxes. All About the Net Investment Income Tax.

This increase will affect individuals estates and trusts on the lesser of the taxpayers net. The net investment income tax affects individuals estates and trusts for tax years beginning on or after Jan. If an individual has income from investments the individual may be subject to net investment income tax.

More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS. 2021-12-17 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of individuals estates and trusts that exceed statutory threshold amounts. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income.

The applicable threshold amount is the. Your net investment income is less than your MAGI overage. Or The excess if any of AGI as defined in section 67e over the applicable threshold amount.

Applying The New Net Investment Income Tax To Trusts And Estates

Distributable Net Income Tax Rules For Bypass Trusts

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

What Is The Net Investment Income Tax Caras Shulman

Applying The New Net Investment Income Tax To Trusts And Estates

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef

What Is Net Investment Income Tax Overview Of The 3 8 Tax

Net Investment Income Tax Niit Quick Guides Asena Advisors

The Stage Is Set For Build Back Better Act 2 0 Levenfeld Pearlstein Llc

Stand For Nav What Is Mean By Nav In 2021 What Is Meant Meant To Be Marketing Definition

What Is The 3 8 Medicare Tax Or Net Investment Income Tax Niit Legal 1031

How To Calculate The Net Investment Income Properly

2021 Year End Tax Planning For Individuals Somerset Cpas And Advisors

Follow Us On Youtube For More Motivation Videos Real Estate Investing Wholesaling Real Estate Investing Money Management Advice

Irs Form 8960 Download Fillable Pdf Or Fill Online Net Investment Income Tax Individuals Estates And Trusts 2020 Templateroller

Net Investment Income Tax For 1040 Filers Perkins Co

Distributable Net Income Tax Rules For Bypass Trusts

How To Calculate The Net Investment Income Properly

Revocable Living Trust Flow Chart For Estate Planning Revocable Living Trust Living Trust Estate Planning